unemployment tax break refund forum

It is not your tax refund. This is an optional tax refund-related loan from MetaBank NA.

K 1 Line 20 Ah Other Information

Depends on how much unemployment you received also.

. Property Tax Relief Programs. Look on your 1040 on taxes paid out. There have been unconfirmed reports of people.

This year has brought challenges and unprecedented changes to the normal due to the pandemic. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. Employment Taxes to be Withheld.

Thus while you receive wages. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. Refunds for 10200 Unemployment Tax Break to Begin in May.

The IRS is required to reconcile the. Thats the number youll most likely receive closer too. Does anyone know what is going on with the refunds for unemployment tax break.

4k seems a bit much. The amount of the refund will vary per person depending on overall. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

We will begin paying ANCHOR. If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund. The deadline for filing your ANCHOR benefit application is December 30 2022.

Unemployment Taxes Refund. Filing an amended income tax return and seeking a refund requires timely action and careful attention to detail in order to meet all of the Tax Codes requirements. The IRS has sent 87 million unemployment compensation refunds so far.

Its the nature of the current situation. The IRS announced earlier this month that the agency had begun the process of adjusting tax. I received a letter from my state IRS that Im eligible to receive an additional refund due to the 2020 waiver for the taxes on the first 10200 of.

ONLY THOSE WHO ARE AWAITING A SECONDARY REFUND DUE TO THE 10200 UNEMPLOYMENT TAX BREAK. If you were to become unemployed you collect benefits in your state of residence NJ not the state of employment NY. Jump to Latest Follow.

Get your taxes done. Approval and loan amount. Loans are offered in amounts of 250 500 750 1250 or 3500.

Higher Education Leadership Forum

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Higher Education Leadership Forum

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

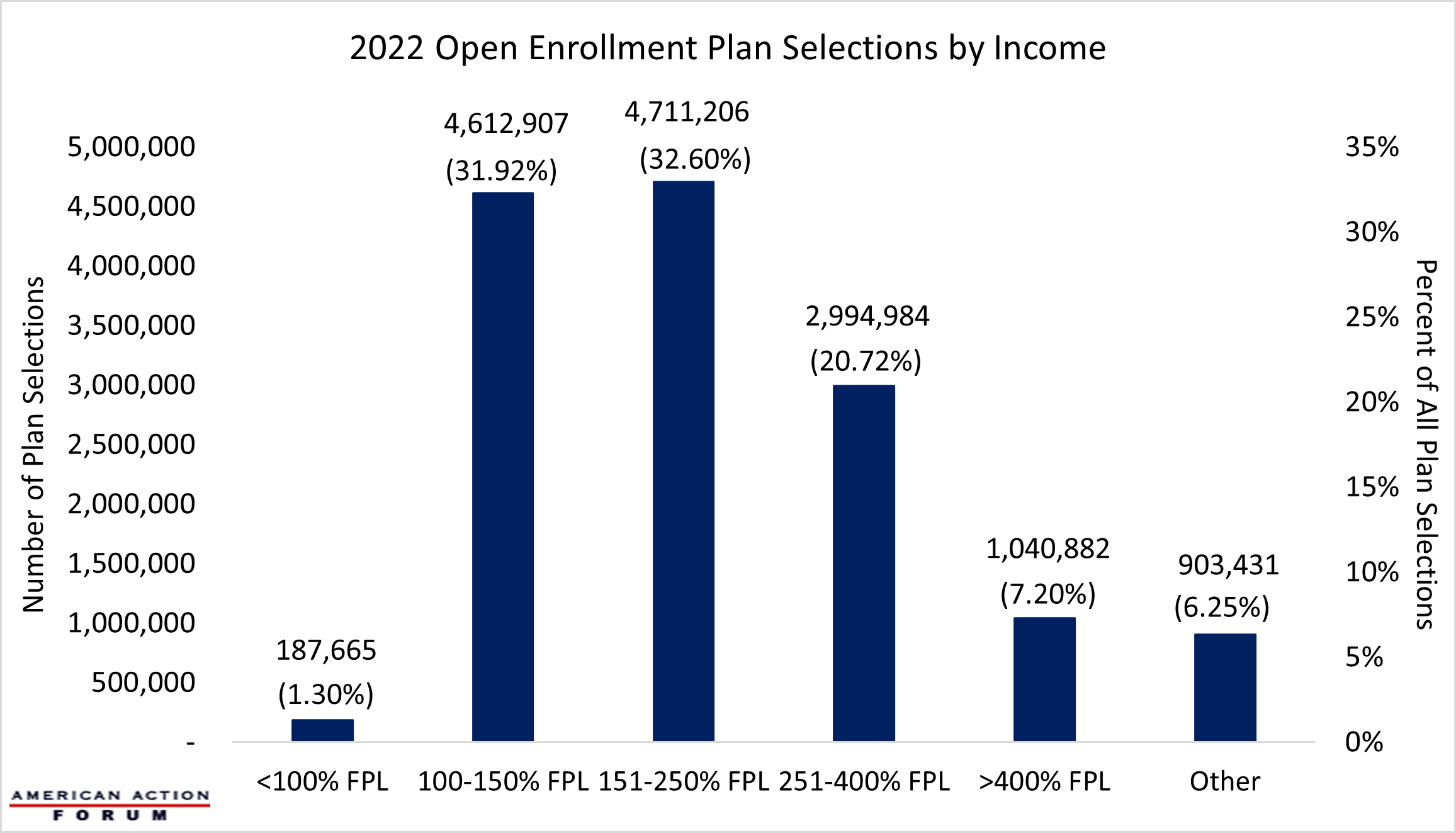

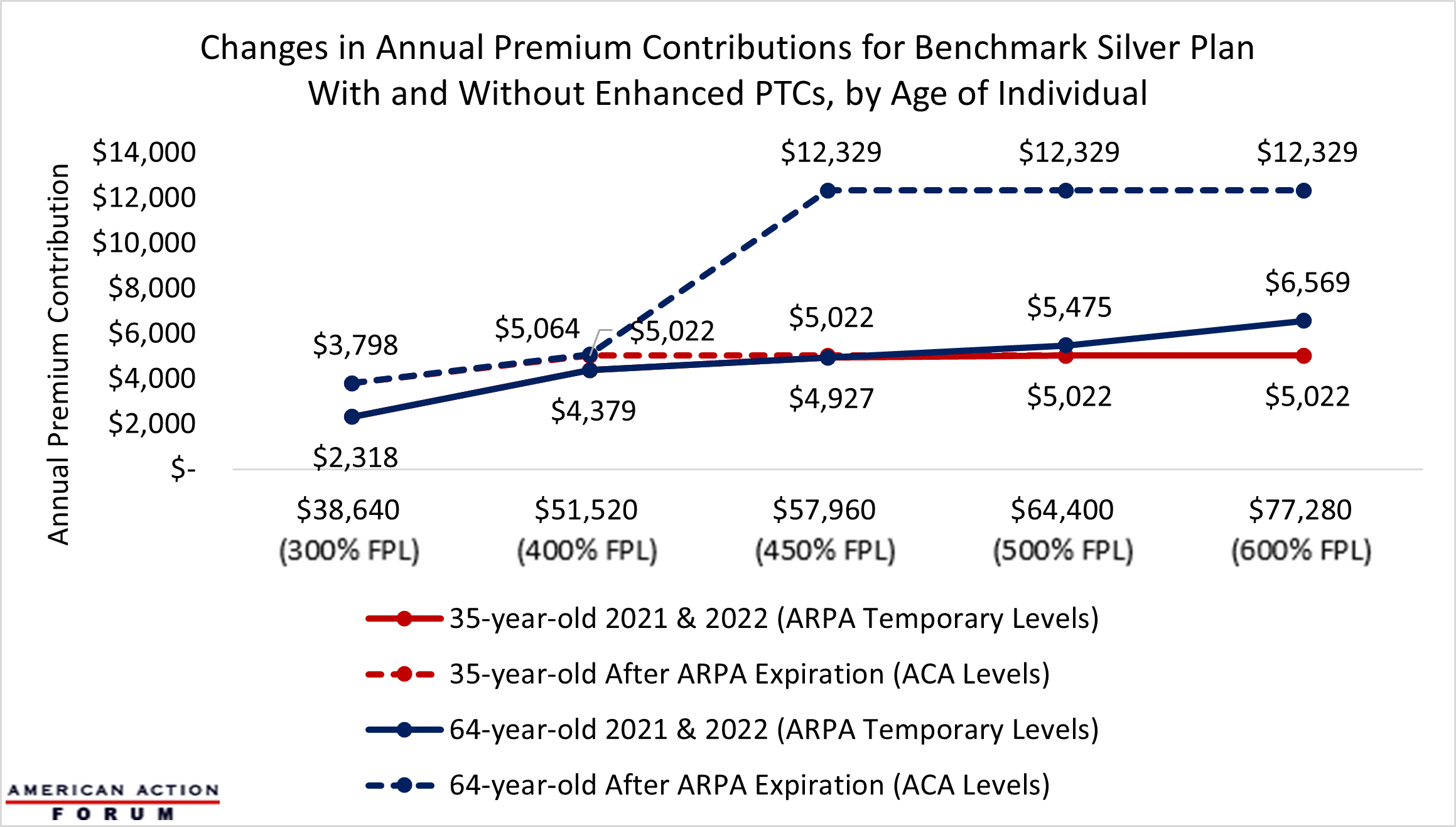

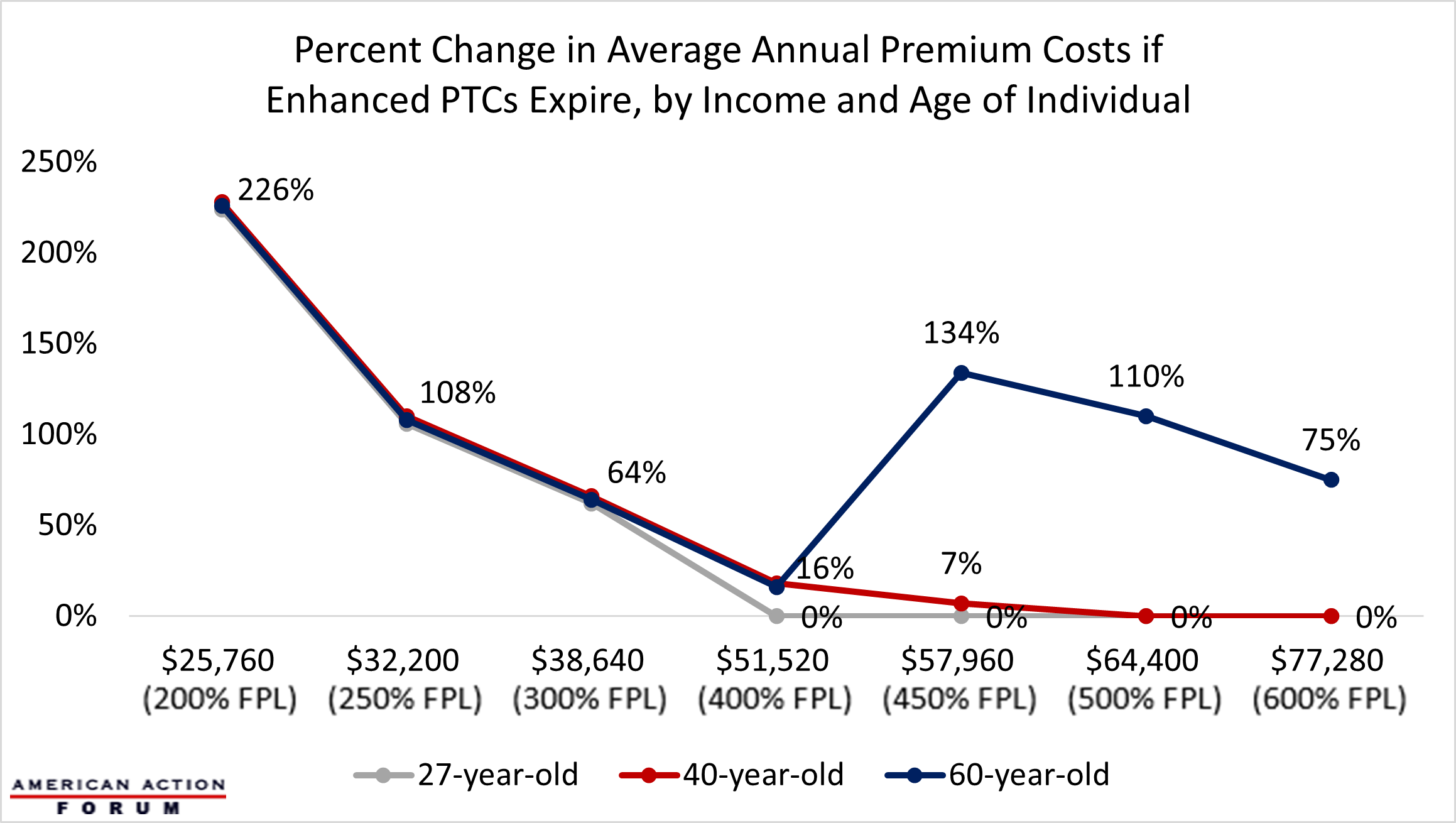

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf

Taxes Ultimate Guide Tax Brackets How To File And How To Save

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Best Free Tax Software 2022 File Your Taxes For Free

Oregon Dept Of Revenue Outlines Unemployment Benefit Tax Relief Steps Ktvz

Acctg 310 Lesson 10 Discussion Forum Docx Lesson 10 Discussion Forum No Unread Replies No Replies Six Of One Half Dozen Of The Other What Is The Course Hero

California Ca Edd Unemployment Benefits Ended For Pua Peuc And 300 Weekly Boost Pandemic Programs Update On Payment Issues Retroactive And Delayed Claims Aving To Invest

Daily Republic Wednesday September 28 2022 By Mcnaughtonmedia Issuu

8 18 20 The Supervisor S Update Town Of Bedford

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Unemployment Refund Where S My Refund

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf